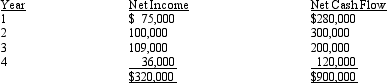

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of four years and no salvage value. The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is .893, .797, .712, and .636, respectively.

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is .893, .797, .712, and .636, respectively.

Required:

Determine the net present value.

Definitions:

Account Receivable

Money owed to a company by its clients or customers for goods or services delivered or used but not yet paid for.

Internal Control

Methods and rules a company adopts to maintain the accuracy of financial and accounting data, encourage responsibility, and stop fraudulent activities.

Establishing Control Procedures

The process of implementing policies and procedures to ensure that an organization's objectives are achieved efficiently and effectively, reducing the risk of fraud or error.

Q37: The standard factory overhead rate is $10

Q62: Lead time includes both value-added time and

Q64: The Everest Company has income from operations

Q75: Responsibility accounting reports for profit centers will

Q83: Inventory reduction is a _ principle.<br>A) just-in-time<br>B)

Q104: The most effective means of presenting standard

Q110: Bugaboo Co. manufactures three types of cookies:

Q111: The just-in-time (JIT) philosophy views inventory as

Q125: Make or buy options often arise when

Q138: The net book value of a fixed