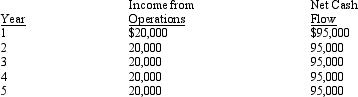

The management of Charlton Corporation is considering the purchase of a new machine costing $380,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The cash payback period for this investment is:

The cash payback period for this investment is:

Definitions:

Relaxation Techniques

Methods or practices designed to reduce tension and stress in the body, often involving breathing exercises, meditation, or physical activity.

Biofeedback

A technique that teaches individuals to control bodily processes that are normally involuntary, like heart rate, through monitoring.

Physical Health Effects

The impact on the body's condition, influenced by behaviors, genetics, and environmental factors.

Mental Health Effects

Consequences or impacts on an individual's psychological well-being and functioning.

Q31: By ignoring and not posting the adjusting

Q39: Vertical analysis is useful for analyzing financial

Q63: The major shortcoming of income from operations

Q73: Tucha Manufacturing Co. operates in a just-in-time

Q114: Miramar Industries manufactures two products, A and

Q121: Vertical analysis compares each item in a

Q131: An 6-year project is estimated to cost

Q158: Cost plus methods determine the normal selling

Q163: If the effect of the credit portion

Q173: Two income statements for PS Enterprises are