Project A requires an original investment of $65,000. The project will yield cash flows of $15,000 per year for seven years. Project B has a calculated net present value of $5,500 over a five year life. Project A could be sold at the end of five years for a price of $30,000. (a) Using the proper table below determine the net present value of Project A over a five-year life with salvage value assuming a minimum rate of return of 12%. (b) Which project provides the greatest net present value?

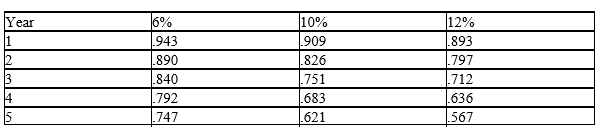

Below is a table for the present value of $1 at compound interest.

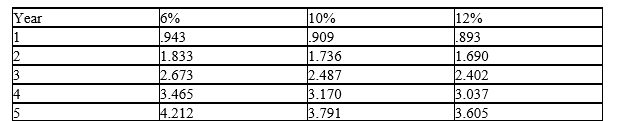

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Dialects

are variations of a language that are specific to a certain region or social group, including differences in vocabulary, grammar, and pronunciation.

Distribution Channels

The pathways through which a product or service is delivered from the producer to the consumer.

Developing Countries

Nations with a lower living standard, underdeveloped industrial base, and low Human Development Index (HDI) relative to other countries.

Distribution Complexity

The degree of difficulty and intricacy involved in distributing products or services from the producer to the consumer.

Q29: Franklin Industries has several divisions. The Northern

Q92: Olsen Company produces two products. Product A

Q93: Multiple production department factory overhead rates are

Q97: When is the adjusted trial balance prepared?<br>A)

Q110: Bugaboo Co. manufactures three types of cookies:

Q119: The accounting rate of return method of

Q135: Mallard Corporation uses the product cost concept

Q145: Hill Co. can further process Product O

Q146: What is the present value of $8,000

Q156: What is the purpose of the adjusted