Project A requires an original investment of $50,000. The project will yield cash flows of $15,000 per year for seven years. Project B has a calculated net present value of $13,500 over a four year life. Project A could be sold at the end of four years for a price of $25,000. (a) Using the proper table below determine the net present value of Project A over a four-year life with salvage value assuming a minimum rate of return of 12%. (b) Which project provides the greatest net present value?

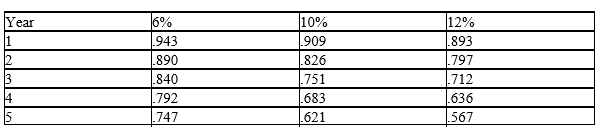

Below is a table for the present value of $1 at compound interest.

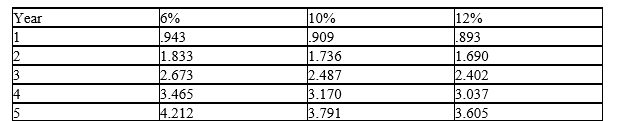

Below is a table for the present value of an annuity of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Disguised Subsidy

Financial support given to industries or businesses in indirect ways, not easily identifiable as traditional subsidies, to lower their costs or increase their competitiveness.

Consumer Surplus

The gap between the total sum consumers are prepared and financially able to spend on a good or service and the sum they actually spend.

Legal

Pertaining to or conforming to the laws of a country or the legality of a situation or activity.

Efficient Output Level

The quantity of output at which a firm's average total cost is minimized.

Q3: A single plantwide overhead rate method is

Q25: Decisions to install new equipment, replace old

Q26: Activity-based costing is determined by charging products

Q26: In capital rationing, an initial screening of

Q81: Connally Company's payroll department required that every

Q87: The Owl Company produces and sells Product

Q97: The Beauty Beyond Words Salon uses an

Q110: The formula to compute direct materials price

Q145: Requirement: Make the journal entries for both

Q160: The amount of increase or decrease in