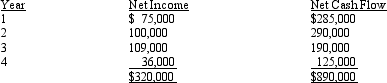

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of four years and no salvage value. The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is .893, .797, .712, and .636, respectively.

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is .893, .797, .712, and .636, respectively.

Required:

Determine the average rate of return on investment, including the effect of depreciation on the investment.

Definitions:

BAT Model

Stands for Behavioral Adjustment Tax, a concept in economic theories but without a standard definition; alternatively, it may refer to niche or specific theoretical models not widely recognized in mainstream economics.

Miller-Orr Model

A financial model used to manage the cash inventory of a firm by setting upper and lower limits on cash balances, determining when to transfer funds.

Cost of Borrowing

The cost of borrowing is the total expense that a company or individual incurs in taking out a loan, including interest payments, fees, and any other charges.

Cash Flows

The net amount of cash being transferred into and out of a business, used as an indicator of financial health.

Q21: A qualitative characteristic that may impact upon

Q52: In a just-in-time (JIT) environment, process problems

Q56: The DuPont formula uses financial information to

Q61: Non-financial accounting information is used more often

Q65: Currently attainable standards do not allow for

Q83: Inventory reduction is a _ principle.<br>A) just-in-time<br>B)

Q90: If the company can not cut costs

Q92: The time expected to pass before the

Q109: Pinacle Corp. budgeted $350,000 of overhead cost

Q133: A bottleneck begins when demand for the