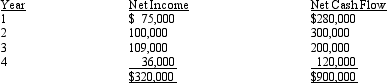

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of four years and no salvage value. The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is .893, .797, .712, and .636, respectively.

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is .893, .797, .712, and .636, respectively.

Required:

Determine the net present value.

Definitions:

Separation Of Duties

A key principle in internal control that involves dividing responsibilities among different personnel or departments to reduce risk of fraud and errors.

CPA Licenses

Certifications granted to accounting professionals who meet the education, experience, and examination requirements of their jurisdiction, allowing them to practice as Certified Public Accountants.

Insuring Assets

The act of obtaining insurance coverage to protect company assets from losses due to risks like fire, theft, or damage.

Technologically Advanced

Referring to the use or development of new and innovative technologies in processes, products, or services.

Q26: Favorable volume variances may be harmful when:<br>A)

Q32: A make-to-order company matches its production schedules

Q38: The amount of increase or decrease in

Q87: Challenger Factory produces two similar products -

Q103: Non-financial measures are often lined to the

Q107: Reducing wait time is not linked to

Q110: In a just-in-time (JIT) environment, the journal

Q116: Office salaries expense for a department store

Q128: The total manufacturing cost variance consists of:<br>A)

Q140: Briefly describe the time value of money.