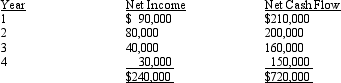

Vanessa Company is evaluating a project requiring a capital expenditure of $480,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return for net present value analysis is 15%. The present value of $1 at compound interest of 15% for 1, 2, 3, and 4 years is .870, .756, .658, and .572, respectively.

The company's minimum desired rate of return for net present value analysis is 15%. The present value of $1 at compound interest of 15% for 1, 2, 3, and 4 years is .870, .756, .658, and .572, respectively.

Determine (a) the average rate of return on investment, using straight line depreciation, and (b) the net present value.

Definitions:

Drug Tolerance

The body's reduced reaction to a drug over time, which can result in needing higher doses to achieve the same effect.

Symptoms

Physical or mental features that are regarded as indicating a condition of disease, noticeable to a patient, often leading to a diagnosis.

Disinhibitor

A factor or substance that reduces inhibition, potentially leading to decreased self-control or increased impulsivity.

Aggressive Behavior

Actions intended to harm or intimidate others, which can be physical, verbal, or nonverbal in nature.

Q12: In using the variable cost concept of

Q31: A factor in determining the rate of

Q41: The underlying principle of allocating operating expenses

Q60: While setting standards, the managers should never

Q70: Adirondak Marketing Inc. manufactures two products, A

Q100: All of the following qualitative considerations may

Q110: A disadvantage to using the residual income

Q120: A company is planning to purchase a

Q126: The method of analyzing capital investment proposals

Q146: Standards that represent levels of operation that