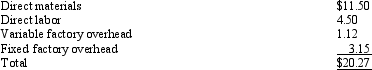

Snipe Company has been purchasing a component, Part Q, for $19.20 a unit. Snipe is currently operating at 70% of capacity and no significant increase in production is anticipated in the near future. The cost of manufacturing a unit of Part Q, determined by the absorption costing method, is estimated as follows:

Prepare a differential analysis report, dated March 12 of the current year, on the decision to make or buy Part Q.

Prepare a differential analysis report, dated March 12 of the current year, on the decision to make or buy Part Q.

Definitions:

Future Value

The future financial worth of an asset or cash that equates to a designated current sum.

Cash Flows

The whole summation of cash transfers affecting a business's in and outflows, prominently affecting its quick access to funds.

Interest Rate

The charge, expressed as a proportion of the principal, required by a lender from a borrower for asset utilization.

Compounded Quarterly

Interest calculation method where interest is added to the principal sum of a deposit or loan every quarter, leading to interest on interest.

Q15: Standards are more widely used for nonmanufacturing

Q71: A project has estimated annual net cash

Q81: A plantwide factory overhead rate is computed

Q84: A company is planning to purchase a

Q99: Activity-based costing is much easier to apply

Q106: A quality control activity analysis indicated the

Q130: Production and sales estimates for June are

Q132: Differential revenue is the amount of income

Q143: The following is a measure of a

Q155: The total cost concept includes all manufacturing