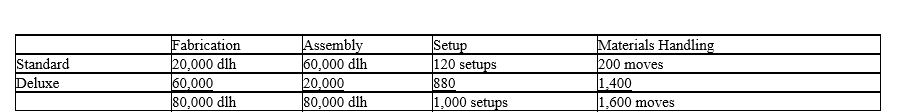

The Canine Company has total estimated factory overhead for the year of $2,400,000, divided into four activities: Fabrication, $1,200,000; Assembly, $480,000; Setup, $400,000; and Materials Handling $320,000. Canine manufactures two products: Standard Crates and Deluxe Crates. The activity-base usage quantities for each product by each activity are as follows:

Each product is budgeted for 20,000 units of production for the year. Determine (a) the activity rates for each activity and (b) the factory overhead cost per unit for each product using activity-based costing.

Definitions:

Compounded Monthly

Interest calculation method where interest is added to the principal sum at the end of each month, leading to interest on interest.

Balance

The amount of money currently in an account or owed on an account at any given time.

Monthly Payments

Regular payments made towards a loan or mortgage each month.

Compounded Semi-Annually

Calculation of interest on the initial principal and the accumulated interest over the first 6 months repeated every half year.

Q22: A business is considering a cash outlay

Q27: In using the variable cost concept of

Q49: Materials used by Best Bread Company in

Q78: If the budgeted factory overhead cost is

Q86: Widgeon Co. manufactures three products: Bales; Tales;

Q91: Magpie Corporation uses the total cost concept

Q102: Income from operations for Division K is

Q141: In net present value analysis for a

Q176: The payback method can be used only

Q192: The manager of a profit center does