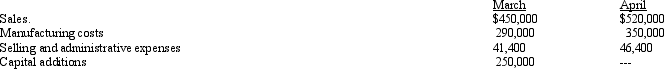

The treasurer of Systems Company has accumulated the following budget information for the first two months of the coming year:

The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are expected to be collected in full in the month of the sale and the remainder in the month following the sale. One-fourth of the manufacturing costs are expected to be paid in the month in which they are incurred and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the probable monthly selling and administrative expenses. Insurance is paid in February and a $40,000 installment on income taxes is expected to be paid in April. Of the remainder of the selling and administrative expenses, one-half are expected to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are expected to be paid in March.

The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are expected to be collected in full in the month of the sale and the remainder in the month following the sale. One-fourth of the manufacturing costs are expected to be paid in the month in which they are incurred and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the probable monthly selling and administrative expenses. Insurance is paid in February and a $40,000 installment on income taxes is expected to be paid in April. Of the remainder of the selling and administrative expenses, one-half are expected to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are expected to be paid in March.

Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of $51,000. Current liabilities as of March 1 are composed of accounts payable of $121,500 ($102,000 for materials purchases and $19,500 for operating expenses). Management desires to maintain a minimum cash balance of $20,000.

Prepare a monthly cash budget for March and April.

Definitions:

Bone Loss

The reduction in bone density and mass, often associated with conditions such as osteoporosis or with aging.

Estrogen

A group of steroid hormones that promote the development and maintenance of female characteristics of the body.

Testosterone

Male sex hormone that helps maintain sexual organs and secondary sex characteristics.

Heart Attack

Damage to the myocardium due to blocked circulation in the coronary arteries; myocardial infarction.

Q12: The profit margin for Division B is

Q19: Chicks Corporation had $1,100,000 in invested assets,

Q64: Employees view budgeting more positively when goals

Q80: In an investment center, the manager has

Q94: Division A of Mocha Company has sales

Q111: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2083/.jpg" alt=" 0 Calculate the

Q145: If sales are $820,000, variable costs are

Q157: Which of the following accounts are debited

Q191: Rental charges of $40,000 per year plus

Q208: Of the following, which will determine if