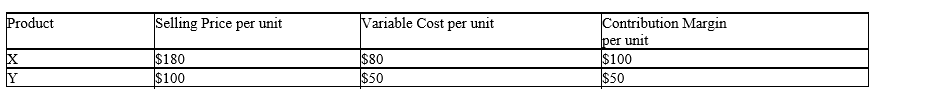

Steven Company has fixed costs of $160,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below.

The sales mix for product X and Y is 60% and 40% respectively. Determine the break-even point in units of X and Y.

The sales mix for product X and Y is 60% and 40% respectively. Determine the break-even point in units of X and Y.

Definitions:

Call Option

A financial contract giving the buyer the right, but not the obligation, to buy a stock, bond, commodity, or other assets at a specified price within a specific time period.

Volatility

The degree of variation of a trading price series over time, often used to gauge the risk in investments.

Put-call Parity

A principle in options pricing that shows the relationship between European put and call options with the same strike price and expiration date.

Risk-free Rate

The risk-free rate is the theoretical return of an investment with zero risk, representing the interest an investor would expect from an absolutely risk-free investment over a specified period.

Q39: If sales total $2,000,000, fixed costs total

Q50: Prime costs are the combination of direct

Q76: Equivalent units of production are the number

Q89: The portion of whole units that were

Q98: The relative distribution of sales among various

Q118: Period costs include direct materials and direct

Q121: Liability accounts are increased by debits.

Q149: The debits to Work in Process--Assembly Department

Q189: Which of the following is NOT an

Q193: When an accounts payable account is paid