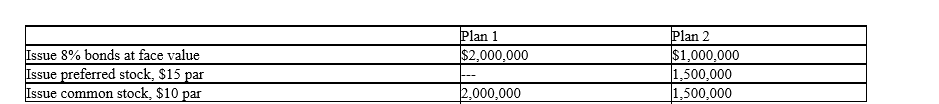

Ulmer Company is considering the following alternative financing plans:

Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.

Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.

Required: Determine the earnings per share of common stock, assuming income before bond interest and income tax is $600,000.

Definitions:

Long-Term Prepayment

Payments made in advance for expenses that will be recognized over a period longer than one year.

Book Value

The net value of a company's assets minus its liabilities and preferred stock, often used to determine the potential value of a company if it were to be liquidated.

Carrying Value

The book value of an asset or liability on a company's balance sheet, calculated as the original cost minus depreciation or amortization.

Unearned Ticket Revenue

Revenue received from ticket sales before the event or service has been provided; also considered a liability until earned.

Q8: On the first day of the fiscal

Q11: Prepare an Income Statement using the following

Q12: The total earnings of an employee for

Q89: When the market rate of interest on

Q89: The entry to record the issuance of

Q105: When a corporation issues bonds, it executes

Q116: Rogers Company reported net income of $35,000

Q131: The payroll register of Seaside Architecture Company

Q144: The excess of issue price over par

Q161: On the statement of cash flows, the