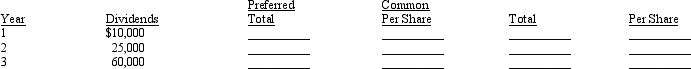

A company had stock outstanding as follows during each of its first three years of operations: 2,500 shares of $10, $100 par, cumulative preferred stock and 50,000 shares of $10 par common stock. The amounts distributed as dividends are presented below. Determine the total and per share dividends for each class of stock for each year by completing the schedule.

Definitions:

Departmental Overhead Rate

A method to allocate overhead costs to specific departments based on certain criteria, such as machine hours or labor costs.

Direct Labor Hours

The total hours worked by employees directly involved in producing goods or services.

Assembling Department

A section within a manufacturing operation where various components are put together to form a finished product.

Activity-based Costing

A method of allocating overhead and indirect costs based on each product's or service's actual consumption of resources.

Q25: Garrett Company sells merchandise with a one

Q34: There is a loss on redemption of

Q67: All of the following are factors contributing

Q97: Suppose pre-tax earnings are $100,000.00 and the

Q107: Blanton Corporation purchased 15% of the outstanding

Q109: Calculate the total amount of interest expense

Q112: The primary purpose of a stock split

Q127: The journal entry a company records for

Q142: A company with 100,000 authorized shares of

Q168: An unfunded pension liability is reported on