On January 1, 2011 a company had the following data:

- issued 10,000 shares of $2.00 par value common stock for $12.00 per share

- issued 3,000 shares of $50 par value 6% cumulative preferred stock for $70 per share

- purchased 1,000 shares of previously issued common stock for $15.00 per share

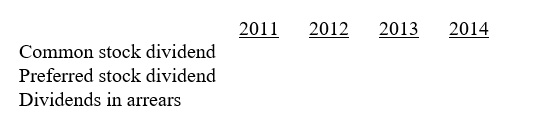

The company had the following dividend information available:

2011 - No dividend paid

2012 - Paid a $2,000 total dividend

2013 - Paid a $17,000 total dividend

2014 - paid a $32,000 total dividend

Using the following format, fill in the correct values for each year;

Definitions:

Sources Of Financing

Various means through which a business or individual can obtain funds, including loans, equity, grants, and savings.

Comparative Financial Statement

Financial reports that provide a side-by-side comparison of a company's financial position and performance over different periods.

Base Period

A specific time period against which economic or financial data is compared or analyzed.

Analysis Period

The specific span of time over which financial performance is evaluated or investment decisions are analyzed.

Q8: The year-end balance of the retained earnings

Q20: Balance sheet and income statement data indicate

Q30: Payroll taxes are based on the employee's

Q41: On August 1, Batson Company issued a

Q46: The price at which a stock can

Q66: Payroll taxes only include social security taxes

Q82: Treasury stock should be reported in the

Q88: Given the following data: <span

Q119: The interest portion of an installment note

Q148: The declaration of a stock dividend decreases