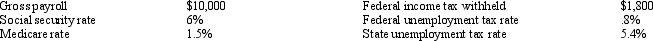

Use the following information to answer the following questions. Assuming no employees are subject to ceilings for their earnings, Jensen Company has the following information for the pay period of January 15 - 31, 20xx. Salaries Payable would be recorded in the amount of:

Salaries Payable would be recorded in the amount of:

Definitions:

Federal Income Tax

A charge imposed by the IRS on the yearly income of persons, companies, trusts, and other legal bodies.

Withheld

Amount of an employee's pay withheld by the employer for tax or other purposes.

Matched By Employer

Contributions made by an employer towards a benefit scheme (e.g., pension, health insurance) that match the contributions made by employees.

Warranty Expense

The cost that a company anticipates or incurs to repair, replace, or compensate for a faulty product under warranty.

Q25: Garrett Company sells merchandise with a one

Q29: Depreciation expense of $2,000.00 will cause:<br>A) accounts

Q40: Amounts withheld from each employee for Social

Q59: The charter of a corporation provides for

Q62: On April 1, 10,000 shares of $5

Q64: What is double taxation?<br>A) It is when

Q88: Gowen, Inc. began the year with equity

Q167: The following totals for the month of

Q175: The effective interest method produces a constant

Q183: The accountant for Franklin Company prepared the