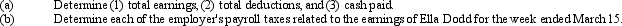

The following information is for employee Ella Dodd for the week ended March 15.

Total hours worked: 48

Rate: $15 per hour, with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% on maximum earnings of $100,000. Medicare tax:

1.5% on all earnings.

State unemployment: 3.4% on maximum earnings of $7,000; on employer

Federal unemployment: 0.8% on maximum earnings of $7,000; on employer

Definitions:

Previously Unconscious

Refers to thoughts, feelings, desires, or memories that were not accessible to conscious awareness but have become conscious.

Reacts To

Responds to or undergoes a change in presence of another substance or condition.

Mental Disorders

A range of conditions affecting mood, thinking, and behavior, often diagnosed based on symptoms and impairing daily functioning.

Optimal Care

The best possible care given to patients, tailored to meet their specific needs effectively and efficiently.

Q2: All long-term liabilities eventually become current liabilities.

Q17: The initials GAAP stand for<br>A) General Accounting

Q21: Inventory in a manufacturing firm differs from

Q47: The journal entry a company uses to

Q53: Sabas Company has 40,000 shares of $100

Q65: The primary role of accounting is to

Q79: Which of the following is not a

Q92: Bob Johnson is the sole stockholder of

Q110: Retained earnings are:<br>A) a liability.<br>B) profits that

Q125: A large public corporation normally uses registrars