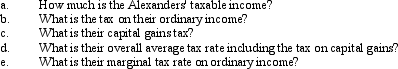

The following is a listing of tax considerations for John and Jane Alexander, who file jointly and have two children.

Assume the following hypothetical tax table:

The personal exemption rate is $3,050

The long-term capital gains rate for this family is 18%.

Definitions:

Free Will

The concept that individuals have the ability to make choices that are not predetermined by past events, emphasizing personal autonomy and ethical responsibility.

Career Adaptability

Readiness and resources to cope with repeated career decisions and challenges.

Career Maturity

The level of a person's readiness and competence in making career-related decisions.

Career Development

The progression and growth of an individual’s career over time, involving changes in roles, responsibilities, and skill enhancement.

Q10: Indicate whether each of the following represents

Q32: The following is a listing of

Q76: If the yield curve is normal, what

Q100: Generally, merchandise is sold on credit under

Q107: Mobile Sales has five sales employees which

Q113: All financial statements are identified by the

Q135: Revenues are reported when<br>A) a contract is

Q171: Williamson Trucking has current sales of $10,000

Q173: The assets and liabilities of S&P Day

Q188: Indicate how the following transactions affect the