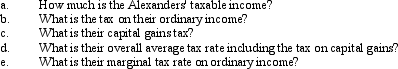

The following is a listing of tax considerations for John and Jane Alexander, who file jointly and have two children.

Assume the following hypothetical tax table:

The personal exemption rate is $3,050

The long-term capital gains rate for this family is 18%.

Definitions:

Collective Efforts

The combined and coordinated actions or endeavors of a group of people working towards a common goal or objective.

Public Needs

Refers to the requirements or desires that are common among the general population or a community, often used to guide government policies or initiatives.

Public Service

Services provided by the government or public entities to meet the needs of the public and enhance the welfare of the community.

Earned Income

Money received from work performed, such as wages, salaries, or tips.

Q8: The following items are components of

Q14: The over-the-counter market differs from the New

Q24: Small firm planning processes cover the same

Q73: Which of the following best describes the

Q82: If total assets decreased by $88,000 during

Q85: Financial assets can be distinguished from real

Q89: A partial financial plan for Blatt Inc.

Q89: An S-type corporation is different from a

Q119: Which is not associated with the Sarbanes-Oxley

Q127: Leverage is the use of equity financing.