Key Graphics expects to finish the current year with the financial results indicated on the worksheet given below. Develop next year's income statement and ending balance sheet using that information and the following planning assumptions and facts. Note that due to an economic slowdown, Key Graphics is expecting a ten percent reduction in revenue. It is attempting to cut expenditures by an even greater percentage, resulting in a larger net profit. Work to the nearest thousand dollars.

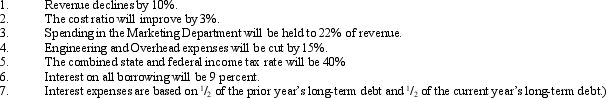

PLANNING ASSUMPTIONS AND FACTS

Income Statement Items

Definitions:

Firm's Beta

A measure of a company's stock volatility compared to the market as a whole, indicating its relative risk.

Profits

The financial gain realized when the amount of revenue gained from a business activity exceeds the expenses, costs, and taxes needed to sustain the activity.

Interest Rate Volatility

The degree of variation of interest rates over time, impacting the valuation of financial instruments and the ability to forecast future rates.

Balance Sheets

Financial statements that summarize a company's financial position, including assets, liabilities, and shareholders' equity at a specific point in time.

Q15: Your uncle promises to give you $550

Q16: When an account is determined to be

Q33: What does non-amortized debt mean?<br>A) Interest payments

Q75: A firm is planning to lower its

Q97: Holding all other variables constant, as market

Q138: What is the rate of return on

Q140: The future value factor for an annuity

Q155: Holding all other variables constant, an increase

Q157: Du Pont analysis breaks a firm's ROE

Q167: A financial intermediary sells shares in itself