Baxter Inc. is in a fast growing industry, but doesn't seem to be able to match its competitors' growth rates. Selected financial information for Baxter is as follows ($000):

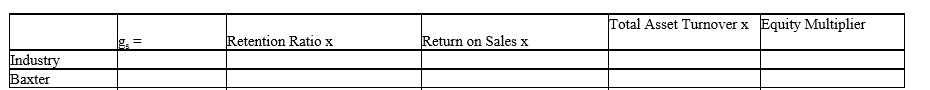

Research has revealed that the average firm in Baxter's industry pays out 10% of its earnings in dividends, earns 4 cents after tax on every sales dollar, has an equity multiplier of 3.0 and a total asset turnover of 1.9.

($000)

($000)

Definitions:

Neonatal Intensive Care Unit Network Neurobehavior Scale (NNNS)

A comprehensive assessment tool designed to evaluate the neurological behaviors, reflexes, and stress responses of newborns, especially those at high risk or in neonatal intensive care.

Substance-Exposed Infants

Substance-exposed infants are babies who were exposed to drugs or alcohol while in the womb, which may lead to various developmental, health, and behavioral issues after birth.

Apgar Scale

A quick test performed on a newborn at 1 and 5 minutes after birth to assess the baby's heart rate, respiration, muscle tone, reflex response, and color for overall health.

Preterm Infant

A baby born before completing 37 weeks of gestation, often requiring special care.

Q5: A firm has current assets of $10,000

Q57: Which of the following is used to

Q61: If a stock has a dividend yield

Q74: A strategic plan consists of:<br>A) short-term issues

Q85: The major audiences for a firm's business

Q121: The coupon rate that is shown on

Q138: Business planning that focuses on the next

Q140: The future value factor for an annuity

Q175: The present value of an investment will

Q186: A business is expected to generate