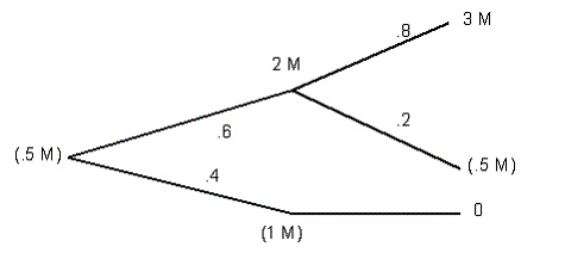

Komarek Forests is considering a new software package that may improve productivity over the next two years. There is a sixty percent chance that the project will be a success in Year 1, earning $2 million and a forty percent change that the venture will fail during the first year resulting in a $1 million loss due to worse asset management than under the current system. The original system would be reinstalled, resulting in no additional losses during the second year.

If the project is a success in the first year, there is an eighty percent chance that it will earn $3 million in the second year. There is a twenty percent chance that the software will be ineffective in Year 2, despite success in Year 1, in which case there would be a loss of $500,000. Assuming a nine percent required rate of return on these, and a total cost of the software system of $500,000, should Komarek install the new system?

Definitions:

TripAdvisor

An online platform that provides reviews and recommendations for hotels, resorts, inns, vacations, travel packages, travel guides, and more.

Cap-and-Trade Program

An environmental policy tool that sets a limit on emissions and allows companies to buy and sell permits for the right to emit greenhouse gases.

Q4: Evaluating several possible cash flow scenarios gives

Q18: The technique for incorporating Risk into capital

Q24: The modified internal rate (MIRR) of return

Q46: If a project has a negative NPV,

Q49: An automatic bias against high-risk projects is

Q60: When calculating the net cash flow in

Q63: Projects with IRRs above the intersection of

Q68: Scenario analysis for a proposed new

Q123: Which of the following best describes the

Q124: What is the internal rate of return