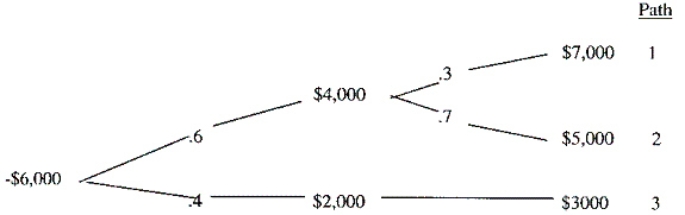

Reading Inc. is contemplating a project represented by the following decision tree. ($000).  Reading is a small firm that is likely to be ruined by a project that loses more than $1.0 million. The firm's cost of capital is 14%. Calculate the project's expected NPV and make a recommendation regarding acceptance.

Reading is a small firm that is likely to be ruined by a project that loses more than $1.0 million. The firm's cost of capital is 14%. Calculate the project's expected NPV and make a recommendation regarding acceptance.

($000):

Definitions:

Same Amount

A situation where a particular value or quantity remains unchanged across different instances or over time.

Present Value

The current assessment of a future sum of money or cash flows, when calculated with an agreed-upon rate of return.

Invest

Directing financial investments towards the achievement of profit or income returns.

Q45: If a firm's EBIT changes by 20%

Q46: Muller, Inc., manufacturer of cardboard boxes, is

Q53: J&J Manufacturing issued $1,000, 30-year bonds 4

Q73: Sunk costs are:<br>A) outlays that have already

Q89: Certain expenditures associated with a project should

Q126: The dividend decision is whether to pay_

Q136: The incremental cash flow principle states that

Q145: Capital rationing may:<br>A) require omitting projects with

Q176: Assume the following facts about a

Q200: A project increases accounts receivable and accounts