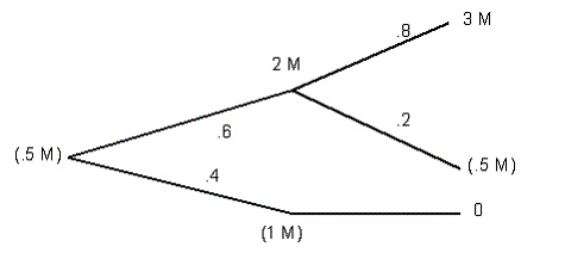

Komarek Forests is considering a new software package that may improve productivity over the next two years. There is a sixty percent chance that the project will be a success in Year 1, earning $2 million and a forty percent change that the venture will fail during the first year resulting in a $1 million loss due to worse asset management than under the current system. The original system would be reinstalled, resulting in no additional losses during the second year.

If the project is a success in the first year, there is an eighty percent chance that it will earn $3 million in the second year. There is a twenty percent chance that the software will be ineffective in Year 2, despite success in Year 1, in which case there would be a loss of $500,000. Assuming a nine percent required rate of return on these, and a total cost of the software system of $500,000, should Komarek install the new system?

Definitions:

Personal Family Experiences

Refers to individual’s unique events, dynamics, and interactions within their family, which shape their identity and perspectives.

Lens

An optical device used in photography or microscopy to focus light and produce images, or metaphorically, a perspective through which an issue is viewed.

Understand

The ability to grasp the meaning, significance, or nature of something.

Race and Ethnicity

Categories used to classify humans into groups based on shared physical or social qualities such as skin color, cultural heritage, and ancestry.

Q3: An outlay of $180,000 is expected to

Q16: One weakness of the internal rate of

Q62: Estimating cash flows is the _ and

Q73: Firms with the _ growth tend to

Q91: The SML represents a state of stable

Q95: The internal rate of return (IRR) is

Q100: A firm's degree of financial leverage is

Q103: Replacement projects tend to require the same

Q153: A stock dividend will not affect which

Q195: A major responsibility of the financial analyst