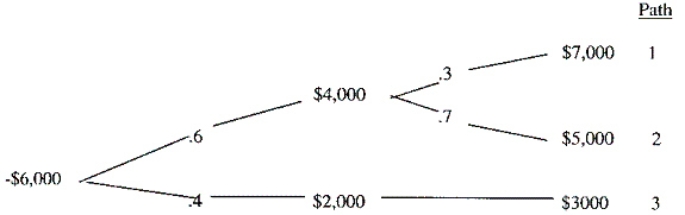

Reading Inc. is contemplating a project represented by the following decision tree. ($000).  Reading is a small firm that is likely to be ruined by a project that loses more than $1.0 million. The firm's cost of capital is 14%. Calculate the project's expected NPV and make a recommendation regarding acceptance.

Reading is a small firm that is likely to be ruined by a project that loses more than $1.0 million. The firm's cost of capital is 14%. Calculate the project's expected NPV and make a recommendation regarding acceptance.

($000):

Definitions:

Average Costs

The total costs (fixed and variable) divided by the total output, indicating the cost per unit of output produced.

Decreasing Returns to Scale

A situation in which, when the scale of production is increased, the output increases at a proportionally lower rate.

Minimum Efficient Scale

The smallest level of production a company can achieve while still taking full advantage of economies of scale in terms of costs per unit.

Long-Run Average Cost Curve

A graphical representation showing the lowest average cost of producing any output level when all inputs can be varied.

Q10: The following information pertains to the capital

Q54: Conflicting arguments continue as to the impact

Q58: Decision tree analysis shows a project to

Q63: Which of the following is not true

Q69: The central issue in the study of

Q146: The _ of a resource is its

Q147: A fundamental question in setting dividend policy

Q157: A firm's degree of financial leverage is

Q170: Sunk costs are monies that have already

Q193: In Modigliani and Miller's most basic model,