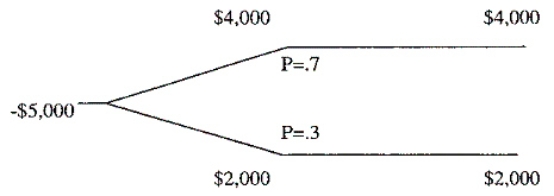

Contico Corp is evaluating a capital budgeting project and has come up with the following two-branch decision tree analysis ($000). Contico's cost of capital is 12%. What is the project's NPV?  ($000)

($000)

Definitions:

Investment

The act of allocating resources, usually money, with the expectation of generating an income or profit, often through the acquisition of assets.

Government Spending

Expenditures made by the government for its operations, provision of public services, or to stimulate the economy.

Imports

Products and offerings imported from foreign countries for the purpose of being sold.

Government Purchases

Expenditures made by the government for goods and services including infrastructure, public services, and national defense.

Q60: Explain the certainty equivalent approach.

Q62: The NPV and IRR derived from estimated

Q67: A firm pays its bondholders a 12%

Q121: A firm's balance sheet discloses cash of

Q133: Blackstone, Inc. is considering expanding operations. The

Q146: Which of the following component costs is

Q150: A four-year-old asset is to be replaced

Q168: Allen Company is considering a capital budgeting

Q185: A DFL (degree of financial leverage) of

Q200: A project increases accounts receivable and accounts