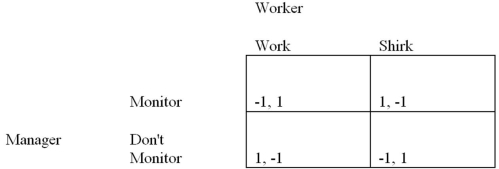

Suppose that you are a manager. You are considering whether or not to monitor employees with the payoffs in the normal-form game shown below.  Management and a labor union are bargaining over how much of a $50 surplus to give to the union. The $50 is divisible up to one cent. The players have one shot to reach an agreement. Management has the ability to announce what it wants first, and then the labor union can accept or reject the offer. Both players get zero if the total amounts asked for exceed $50. If you were the labor union, which type of "rules of play" would you prefer to divide the $50 surplus?

Management and a labor union are bargaining over how much of a $50 surplus to give to the union. The $50 is divisible up to one cent. The players have one shot to reach an agreement. Management has the ability to announce what it wants first, and then the labor union can accept or reject the offer. Both players get zero if the total amounts asked for exceed $50. If you were the labor union, which type of "rules of play" would you prefer to divide the $50 surplus?

Definitions:

Standard Deviation

A statistical measure that quantifies the dispersion or spread of a set of data points or investment returns around their mean.

Risk-Free Rate

The theoretical rate of return of an investment with no risk of financial loss, often represented by the yield on government bonds.

Optimal Risky Portfolio

An investment portfolio that offers the highest expected return for a given level of risk or the lowest risk for a given level of expected return.

Beta

A measure of a security's volatility in relation to the overall market, indicating the security's risk compared to the market average.

Q8: Which of the following is true under

Q23: A network linking six users is typically:<br>A)

Q30: Suppose the market for computer chips is

Q59: In a Cournot oligopoly, a decrease in

Q64: Which of the following market structures would

Q77: In the presence of _, the market

Q79: Consider the monopoly in the figure below

Q89: The Bertrand model of oligopoly reveals that:<br>A)

Q103: Many tout that the Internet has lowered

Q104: Suppose that there are two industries, A