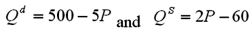

Suppose you are an aide to a U.S. Senator who is concerned about the impact of a recently proposed excise tax on the welfare of her constituents. You explained to the Senator that one way of measuring the impact on her constituents is to determine how the tax change affects the level of consumer surplus enjoyed by the constituents. Based on your arguments, you are given the go-ahead to conduct a formal analysis, and obtain the following estimates of demand and supply:  .

.

a. Graph the supply and demand curves.

b. What are the equilibrium quantity and equilibrium price?

c. How much consumer surplus exists in this market?

d. If a $2 excise tax is levied on this good, what will happen to the equilibrium price and quantity?

e. What will the consumer surplus be after the tax?

Definitions:

Fully Depreciated

A state where an asset's cost has been completely expensed over its useful life, reducing its book value to zero or salvage value.

Machinery

Tangible assets used in operations, such as production or manufacturing equipment, that have a useful life beyond one year.

Amortize

The process of spreading out a loan or an intangible asset cost over a specific period of time for accounting and tax purposes.

Accumulated Depreciation

The total depreciation that has been applied to a fixed asset since it was acquired, representing the loss of value over time.

Q5: Spencers Magic Shows Incorporated is financed 100%

Q31: The bell curve is a graphical representation

Q41: The rate used to determine the sales

Q65: Suppose the income elasticity for transportation is

Q67: If quantity demanded for sneakers falls by

Q71: If a worker receives a fixed payment

Q110: Your firm's research department has estimated the

Q132: Consider a market characterized by the following

Q142: Given a linear supply function of the

Q144: Suppose earnings are given by E =