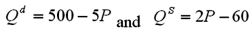

Suppose you are an aide to a U.S. Senator who is concerned about the impact of a recently proposed excise tax on the welfare of her constituents. You explained to the Senator that one way of measuring the impact on her constituents is to determine how the tax change affects the level of consumer surplus enjoyed by the constituents. Based on your arguments, you are given the go-ahead to conduct a formal analysis, and obtain the following estimates of demand and supply:  .

.

a. Graph the supply and demand curves.

b. What are the equilibrium quantity and equilibrium price?

c. How much consumer surplus exists in this market?

d. If a $2 excise tax is levied on this good, what will happen to the equilibrium price and quantity?

e. What will the consumer surplus be after the tax?

Definitions:

Product Alternatives

Different products or services that serve the same purpose or fulfill the same need for a consumer, offering options in the marketplace.

Segmentation Variables

Criteria used to divide a market into clearly identifiable segments based on needs, behaviors, or demographics.

Purple Cows

A metaphor for products or services that are extraordinarily unique and stand out in a market, coined by marketing expert Seth Godin.

Competitive Advantage

A condition that allows a company or country to produce a good or service of equal value at a lower price or in a more desirable fashion for customers.

Q2: Which of the following properly describes the

Q15: The consequences to a corporation for failure

Q19: The coefficient of variation measures the amount

Q23: The difference between an ordinary annuity and

Q28: What is the maximum amount of good

Q45: When the price of one good decreases,

Q97: How does a decrease in the price

Q122: Given a linear supply function of the

Q123: In the early part of 1998, crude

Q144: If the cross-price elasticity between goods A