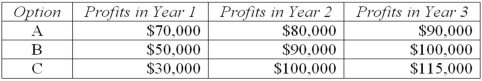

You have just been hired as a consultant to help a firm to decide which of three options to take to maximize the value of the firm over the next three years. The following table shows year-end profits for each option. Interest rates are expected to be stable at 8 percent over the next three years.  a. Discuss the difference in the profits associated with each option. Provide an example of real-world options that might generate such profit streams.

a. Discuss the difference in the profits associated with each option. Provide an example of real-world options that might generate such profit streams.

b. Which option has the greatest present value?

Definitions:

Group Norms

Shared expectations and rules that guide behavior of members within a group, influencing conformity and group dynamics.

Social Comparisons

The process of comparing oneself to others in order to evaluate or enhance one's own qualities or abilities.

Ethical Issue

A dilemma or situation that requires a choice to be made between competing values or principles.

Milgram's Obedience

A series of experiments conducted by Stanley Milgram, demonstrating people's willingness to obey authority figures even when asked to perform actions conflicting with their personal conscience.

Q1: Wiley & Jose's Corporation currently pays a

Q7: The best definition of risk averse is<br>A)never

Q10: Assets are held by the firm to

Q23: Which of the following is not a

Q33: The suffix oma means _.<br>A)Cutting into<br>B)Enlargement of<br>C)Surgically

Q33: In a competitive market, the market demand

Q34: If a $1,000 bond is selling for

Q55: When the price of sugar was "low,"

Q70: A group of signs and symptoms is

Q132: If the interest rate is 3 percent,