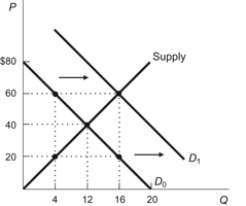

Figure: Demand Shift  In the figure, the demand curve shifted from D0 to D1. To describe this movement, we would say that:

In the figure, the demand curve shifted from D0 to D1. To describe this movement, we would say that:

Definitions:

Income Tax

Income tax is a tax levied by governments on individuals or entities based on their income or profits, with rates varying according to income levels.

Consumption

Households utilizing products and services for their needs.

Horizontal Equity

The principle that individuals with similar income and ability should be treated equally by the taxation system, ensuring fairness.

Economic Income

The total value of all earnings received over a period of time, including wages, rental income, interest, and profits.

Q26: If there is a surplus of a

Q57: A subsidy causes deadweight loss:<br>A) only because

Q98: (Figure: Coffee and Comic Books) Refer to

Q113: The key condition for equilibrium to occur

Q116: A wage subsidy would:<br>A) decrease the demand

Q207: Throughout 2005, average home prices in the

Q225: Why is the demand curve for oil

Q234: (Figure: Gains from Trade) Refer to the

Q245: Figure: Supply Elasticity <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3377/.jpg" alt="Figure: Supply

Q248: The demand for an inferior good increases