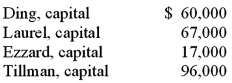

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.

Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

If the assets could be sold for $228,000, what is the minimum amount that Ding's creditors would have received?

Definitions:

Supreme Court

The highest judicial court in a country or state, often having the final say in legal matters and interpretations of the law.

Social Welfare

Government or private programs aimed at providing assistance and support to individuals or groups in need.

Spending Power

Spending power, or fiscal power, refers to the ability of a governing body to mobilize monetary resources or funds for various expenditures to influence the economy.

Congress

The legislative branch of the United States federal government, consisting of the House of Representatives and the Senate.

Q3: As of January 1, 2011, the partnership

Q16: Dancey, Reese, Newman, and Jahn were partners

Q23: The balance sheets of Butler, Inc. and

Q28: Car Corp. (a U.S.-based company) sold parts

Q47: How does the existence of a non-controlling

Q67: Which accounts are remeasured using current exchange

Q75: The dissolution of a partnership occurs<br>A) only

Q91: Coyote Corp. (a U.S. company in Texas)

Q100: Davidson, Inc. owns 70 percent of the

Q123: Pot Co. holds 90% of the common