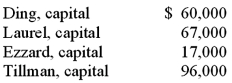

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.

Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

If the assets could be sold for $228,000, what is the minimum amount that Laurel's creditors would have received?

Definitions:

Job Specifications

A detailed description of the qualifications, skills, and experience required to perform a specific job.

Performance Appraisal

A regular review and evaluation of an individual's job performance and overall contribution to an organization.

Employee Empowerment

The practice of giving employees the authority, tools, and resources to make decisions and contribute to the company's success.

Organizational Culture

The shared values, beliefs, and practices that shape the social and psychological environment of a business, influencing employee behavior and company operations.

Q9: On January 1, 2009, Nichols Company acquired

Q20: The Amos, Billings, and Cleaver partnership had

Q27: The company's _ deals with all legal

Q70: Quadros Inc., a Portuguese firm was acquired

Q76: When sending an email, it is appropriate

Q89: In translating a foreign subsidiary's financial statements,

Q95: When recording a professional voice mail greeting,

Q103: On January 1, 2011, Riley Corp. acquired

Q122: _ is based upon an individual's ability

Q134: _ is a favorable or unfavorable judgment