Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

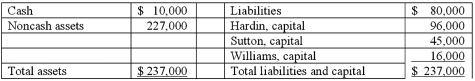

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

Definitions:

Additional Revenue

Extra income received by a business or government beyond what was originally forecasted or expected.

Factor of Production

Resources used in the production of goods and services, such as labor, capital, land, and entrepreneurship.

Demand

The quantity of a product or service that consumers are willing and able to purchase at various prices during a specific time period.

Productivity

Refers to the efficiency of production in terms of units produced per unit of input, such as labor or capital.

Q21: Partnerships have alternative legal forms including all

Q40: When preparing to go to work, a

Q46: Appropriate items for a man's work wardrobe

Q50: Westmore, Ltd. is a British subsidiary of

Q53: Supervisors work on strategic issues.

Q53: Proprietary funds are<br>A) Funds used to account

Q55: The way you look and behave is

Q64: The Keaton, Lewis, and Meador partnership had

Q97: Stark Company, a 90% owned subsidiary of

Q111: Tactical issues identify how to link strategy