Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

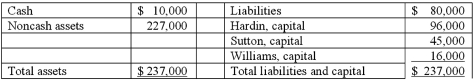

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Prepare journal entries to record the actual liquidation transactions.

Definitions:

Settlement Date

The specific date on which a financial transaction is completed and contractual obligations must be fulfilled.

Payment Due

The amount of money that must be paid by a certain date to avoid incurring late fees or default.

Year End

The end of a fiscal year or accounting period, at which time companies summarize financial activities.

Spot Rate

The current market price used to directly exchange one currency for another, for immediate delivery.

Q1: You electronic communication devices may be used

Q22: A partnership began its first year of

Q23: Parker Corp., a U.S. company, had the

Q23: The capital account balances for Donald &

Q29: Major functions of a company grouped together

Q47: The Keaton, Lewis, and Meador partnership had

Q63: Dalton Corp. owned 70% of the outstanding

Q66: When leaving a voice message, talk fast

Q74: Gargiulo Company, a 90% owned subsidiary of

Q94: When leaving a telephone message:<br>A) Speak clearly