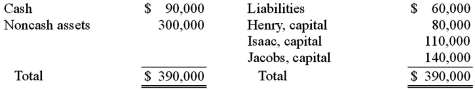

The Henry, Isaac, and Jacobs partnership was about to enter liquidation with the following account balances:

Estimated expenses of liquidation were $5,000. Henry, Isaac, and Jacobs shared profits and losses in a ratio of 2:4:4.

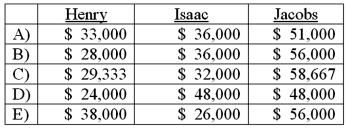

Before liquidating any assets, the partners determined the amount of cash for safe payments and distributed it. The noncash assets were then sold for $120,000. The liquidation expenses of $5,000 were paid. How much of the $120,000 would be distributed to the partners? (Hint: Either a predistribution plan or a schedule of safe payments would be appropriate for solving this item.)

Definitions:

Q13: As of January 1, 2011, the partnership

Q14: The Keaton, Lewis, and Meador partnership had

Q15: When answering a phone call:<br>A) Tell others

Q45: A five-year lease is signed by the

Q47: The Keaton, Lewis, and Meador partnership had

Q56: Directional statements include a company's:<br>A) Values and

Q63: Carlson, Inc. owns 80 percent of Madrid,

Q77: A product is always an intangible item.

Q91: Coyote Corp. (a U.S. company in Texas)

Q92: A workplace dress code may address:<br>A) Jewelry<br>B)