Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

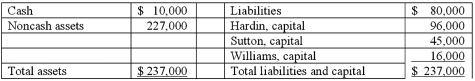

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

Definitions:

Current Maturities

The portion of long-term debt that is due to be paid within the next year.

Conversion Privileges

Options embedded in financial instruments that allow the holder to change the instrument into another, typically from a bond to stock.

Interest Rates

The percentage of a sum of money charged for its use, determined by the lender and agreed upon by the borrower.

Earnings Per Share

A company's net profit divided by the number of its outstanding shares, indicating how much money each share makes.

Q31: On January 1, 2011, Harrison Corporation spent

Q34: A standard of social behavior is called:<br>A)

Q42: On August 21, 2011, Fred City transferred

Q49: I you speak poorly of your company

Q56: Ryan Company owns 80% of Chase Company.

Q66: When leaving a voice message, talk fast

Q68: Thomas Inc. had the following stockholders' equity

Q85: Dilty Corp. owned a subsidiary in France.

Q86: On January 1, 2009, Nichols Company acquired

Q94: _ issues deal with implementing the company