Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

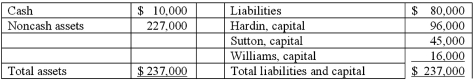

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

Definitions:

Organization

A structured group of people who come together to achieve common goals through a coordinated effort.

Manager

A manager is someone responsible for directing and controlling the work and staff of a business, or a part of a business, to achieve set objectives.

Management Functions

The core roles and activities undertaken by managers, including planning, organizing, leading, and controlling, to achieve organizational goals.

Mintzberg's Managerial Roles

A framework that categorizes a manager's job into ten roles divided into three categories: interpersonal, informational, and decisional.

Q3: As of January 1, 2011, the partnership

Q19: Simple City has recorded the purchase order

Q22: Basic rules for the appropriate use of

Q23: Which item is not included on the

Q45: When comparing the difference between an upstream

Q53: Jerry, a partner in the JSK partnership,

Q73: Under the current rate method, depreciation expense

Q76: Middle managers:<br>A) Are commonly referred to as

Q80: Walsh Company sells inventory to its subsidiary,

Q92: Gargiulo Company, a 90% owned subsidiary of