Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

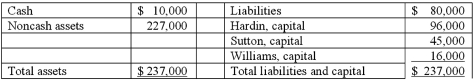

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Prepare journal entries to record the actual liquidation transactions.

Definitions:

Directive

An instruction or order given by someone in authority.

Authentic

Refers to something genuine, not counterfeit or copied, and truly represents what it is said to be.

Gestalt Therapy

A type of therapy that highlights the importance of taking personal accountability and concentrates on the person's current experiences.

Self-actualization

The realization or fulfillment of one's talents and potentialities, considered as a drive or need present in everyone. It is the highest level of Maslow's hierarchy of needs.

Q5: What is the preferred method of resolving

Q9: On January 1, 2009, Nichols Company acquired

Q13: Webb Company owns 90% of Jones Company.

Q28: What accounting transactions are not recorded by

Q33: Cleary, Wasser, and Nolan formed a partnership

Q36: Which of the following characteristics is not

Q41: A local partnership was in the process

Q49: The president or chief executive officer reports

Q73: Marketing is responsible for creating, pricing, and

Q76: Try to minimize your personal accounts when