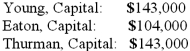

A partnership began its first year of operations with the following capital balances:

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Young's total share of net loss for the first year?

Definitions:

New Deal

An array of measures such as programs, public construction efforts, fiscal changes, and rules implemented in the United States during the 1930s by President Franklin D. Roosevelt to address the Great Depression.

National Recovery Administration

A New Deal agency established in 1933 to combat the Great Depression by setting business codes and labor standards.

Great Depression

A severe worldwide economic depression that took place mostly during the 1930s, beginning in the United States.

Global Phenomenon

A term used to describe trends, movements, or events that extend across borders and cultures, affecting or involving people worldwide.

Q6: How does a gain on an intra-entity

Q12: The use of wikis is currently the

Q19: It is appropriate to always tag workplace

Q42: All of the following hedges are used

Q58: For a government, what kinds of operations

Q59: On October 1, 2011, Eagle Company forecasts

Q63: On January 1, 2011, Lamb and Mona

Q64: Most employers provide common technological tools:<br>A) For

Q67: An intra-entity sale took place whereby the

Q89: Output:<br>A) Adds value to a company<br>B) Must