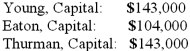

A partnership began its first year of operations with the following capital balances:

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Eaton's total share of net income for the second year?

Definitions:

Quality

The degree to which a set of inherent characteristics fulfills requirements.

Stockholders' Equity

The residual interest in the assets of a corporation that remains after deducting its liabilities, representing the ownership interest of shareholders in the company.

Total Asset Turnover

A financial ratio that measures a company's efficiency in using its assets to generate revenue.

Total Assets

Total assets represent the sum of everything of value owned by a company, including tangible and intangible resources, which are reported on a company's balance sheet.

Q7: The Finance and Accounting Department is responsible

Q15: When answering a phone call:<br>A) Tell others

Q33: A foreign subsidiary uses the first-in first-out

Q37: If a difficult customer becomes abusive:<br>A) Take

Q55: The _ function deals with the production

Q73: Jipsom and Klark were partners with capital

Q76: Webb Company owns 90% of Jones Company.

Q76: When sending an email, it is appropriate

Q95: _ customers include purchasers, vendors, and investors.<br>A)

Q103: _ means customers believe they are getting