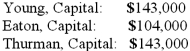

A partnership began its first year of operations with the following capital balances:

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was the balance in Young's Capital account at the end of the second year?

Definitions:

Q10: A U.S. company buys merchandise from a

Q16: Jewelry that makes noise is acceptable to

Q29: On April 7, 2011, Pate Corp. sold

Q44: Virginia Corp. owned all of the voting

Q46: The partners of Donald, Chief & Berry

Q54: Kennedy Company acquired all of the outstanding

Q65: If your electronic communication device use is

Q85: A technology-use policy generally outlines:<br>A) Fees regarding

Q89: All of the following are examples of

Q104: Vontkins Inc. owned all of Quasimota Co.