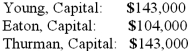

A partnership began its first year of operations with the following capital balances:

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was the balance in Eaton's Capital account at the end of the second year?

Definitions:

Joe Louis

A legendary African American professional boxer and World Heavyweight Champion considered one of the greatest fighters of all time, who made a significant impact in breaking racial barriers in sports.

Black Panther Party

A revolutionary organization founded in 1966 that aimed to promote Black empowerment and protect African American communities from police brutality, using both social programs and armed self-defense.

1966

A year notable for various historical events worldwide, including cultural movements, political changes, and advancements in science and technology.

Oakland, California

A city in the San Francisco Bay Area of California, known for its significant cultural diversity and history of political activism.

Q3: Which one of the following is a

Q9: Which method of translating a foreign subsidiary's

Q24: Stark Company, a 90% owned subsidiary of

Q32: Fargus Corporation owned 51% of the voting

Q35: If you accidentally interrupt someone, finish your

Q40: What is meant by the spot rate?

Q48: Dilty Corp. owned a subsidiary in France.

Q58: Most people in today's workplace are:<br>A) Connected

Q72: What exchange rate would be used to

Q73: Marketing is responsible for creating, pricing, and