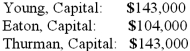

A partnership began its first year of operations with the following capital balances:

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Eaton's total share of net loss for the first year?

Definitions:

Budget Standards

These are predetermined costs or revenues that serve as benchmarks for evaluating the performance of different departments within an organization.

Employees' Involvement

Refers to the extent to which employees can contribute to decision-making processes within a company, impacting its operations and policies.

Master Budget

An all-encompassing financial plan that combines all individual budgets related to sales, cost of goods sold, operations, and capital expenditures.

Chief Executive Officer

The highest-ranking executive in a company, responsible for making major corporate decisions.

Q4: Which method of remeasuring a foreign subsidiary's

Q25: A local government's basic financial statements would

Q32: What is a company's functional currency?<br>A) the

Q58: The ABCD Partnership has the following balance

Q63: On January 1, 2011, Lamb and Mona

Q64: Most employers provide common technological tools:<br>A) For

Q73: When dining with business partners and your

Q74: Withdrawals from the partnership capital accounts are

Q76: When sending an email, it is appropriate

Q85: Virginia Corp. owned all of the voting