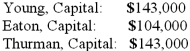

A partnership began its first year of operations with the following capital balances:

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Young's total share of net income for the second year?

Definitions:

Q7: Quadros Inc., a Portuguese firm was acquired

Q17: The balance sheet of Rogers, Dennis &

Q19: Pursley, Inc. owns 70 percent of Harry,

Q22: The leader of a company is typically

Q45: A new truck was ordered for the

Q73: McGraw Corp. owned all of the voting

Q79: With a handshake you do not have

Q83: The appropriate format of the December 31,

Q84: Which of the following approaches is used

Q96: The following information has been taken from