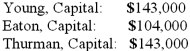

A partnership began its first year of operations with the following capital balances:

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Eaton's total share of net income for the second year?

Definitions:

Delay

A period of time before an event or action takes place.

Aversive Event

An unpleasant or harmful event or stimulus that an organism seeks to avoid or escape.

Avoidance Response

A behavior aimed at preventing an unpleasant or harmful event before it occurs.

Imitate

To copy or mimic the actions, appearance, or speech of another person or thing, often to learn or practice a specific behavior or skill.

Q5: What is the preferred method of resolving

Q8: It is appropriate to use the words

Q17: Perch Co. acquired 80% of the common

Q41: Property taxes of 1,500,000 are levied for

Q47: In today's workplace, it is acceptable and

Q71: _ is when you are exercising manners,

Q73: When a U.S. company purchases parts from

Q79: Cleary, Wasser, and Nolan formed a partnership

Q88: Perch Co. acquired 80% of the common

Q97: Stark Company, a 90% owned subsidiary of