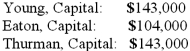

A partnership began its first year of operations with the following capital balances:

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was the balance in Young's Capital account at the end of the second year?

Definitions:

Life Change

A significant shift in one's circumstances, habits, or outlook, typically leading to personal growth or a new direction in life.

Alter

To change or modify something.

Marry

To enter into a legal and cultural relationship of partnership, typically recognized by civil, religious, or social norms.

Family Problem

Issues or conflicts arising within a family unit, affecting the functioning or well-being of its members.

Q17: James, Keller, and Rivers have the following

Q19: Shoes should be in good condition, which

Q34: Which of the following statements is false

Q38: The capital account balances for Donald &

Q49: On January 1, 2011, Harrison Corporation spent

Q54: Which of the following statements is true

Q59: Panton, Inc. acquired 18,000 shares of Glotfelty

Q65: Your _ is how you look.

Q83: Your _ consists of clothes that you

Q88: Always include the business subject in the