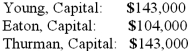

A partnership began its first year of operations with the following capital balances:

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was the balance in Eaton's Capital account at the end of the second year?

Definitions:

Dred Scott V. Sanford

An 1857 U.S. Supreme Court decision that ruled African Americans were not U.S. citizens and that Congress had no authority to prohibit slavery in federal territories, exacerbating sectional tensions that led to the Civil War.

Republican Plan

A strategy or proposal put forward by members of the Republican Party (USA) aimed at addressing political, economic, or social issues.

Supreme Court Decision

A ruling made by the Supreme Court of the United States, serving as the final interpretation of constitutional and legal issues.

Q1: You electronic communication devices may be used

Q6: The quality equation is:<br>A) Profits provide for

Q15: A city operates a central data processing

Q15: Other than e-mail other primary means of

Q19: Simple City has recorded the purchase order

Q31: The City of Nextville operates a motor

Q38: When Jolt Co. acquired 75% of the

Q49: Bay City received a federal grant to

Q62: Participation in a Wiki is a form

Q80: The partnership contract for Hanes and Jones