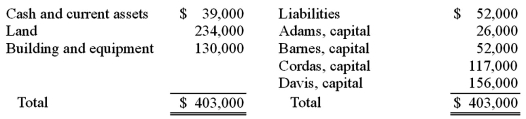

The ABCD Partnership has the following balance sheet at January 1, 2010, prior to the admission of new partner, Eden.

Eden contributed $124,000 in cash to the business to receive a 20% interest in the partnership. Goodwill was to be recorded. The four original partners shared all profits and losses equally. After Eden made his investment, what were the individual capital balances?

Definitions:

Exchange Rate

The price measured in one country’s currency of purchasing one unit of another country’s currency

Employment

The condition of having paid work or the number of people within an economy who are currently employed.

Net Taxes

Refers to the total amount of taxes paid by businesses and individuals to the government, minus any refunds, credits, or benefits received, representing the actual tax burden.

Disposable Income

The amount of money a household or individual has available to spend or save after taxes have been deducted.

Q4: On January 1, 2010, Palk Corp. and

Q10: The following information has been taken from

Q38: Gonda, Herron, and Morse is considering possible

Q42: A customer is one who buys a

Q47: Your attitude assists a company in becoming

Q63: Carlson, Inc. owns 80 percent of Madrid,

Q68: Ways to help the company be successful

Q92: Gargiulo Company, a 90% owned subsidiary of

Q93: Workplace productivity means to perform a function

Q103: In a step acquisition, which of the