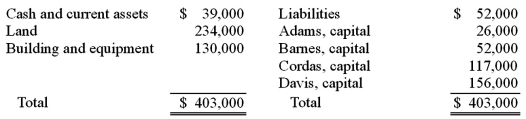

The ABCD Partnership has the following balance sheet at January 1, 2010, prior to the admission of new partner, Eden.

Eden acquired a 20% interest in the partnership by contributing a total of $71,500 directly to the other four partners. Goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: Adams, 15%; Barnes, 35%; Cordas, 30%; and Davis, 20%. After Eden made his investment, what were the individual capital balances?

Definitions:

Suit

A legal action brought by one party against another in a court of law.

Scope Of Employment

Legal concept that determines whether an employee's actions are within the range of tasks assigned by their employer and relevant to their job duties.

Employee's Conduct

The behavior and actions of an individual working for a company, governed by workplace policies and laws.

Courts

Judicial institutions authorized to hear and resolve legal disputes, applying the law to specific cases.

Q3: Employees should be:<br>A) Dependable<br>B) Responsive<br>C) Competent<br>D) All

Q16: On January 1, 2010, Palk Corp. and

Q28: Hambly Corp. owned 80% of the voting

Q28: What accounting transactions are not recorded by

Q46: Illustrate and label the three levels of

Q53: Jerry, a partner in the JSK partnership,

Q58: Most people in today's workplace are:<br>A) Connected

Q70: Which of the following statements is correct

Q101: Which of the following statements is true

Q106: Clemente Co. owned all of the voting