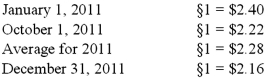

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2011 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2012. A building was then purchased for §170,000 on January 1, 2011. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2011. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Definitions:

Federal Reserve

The central banking system of the United States, which conducts the nation's monetary policy, regulates banks, maintains the stability of the financial system, and provides financial services to depository institutions, the U.S. government, and foreign official institutions.

Monetary Policy

Economic policy tools used by a central bank to control the supply of money, aiming to achieve macroeconomic objectives like controlling inflation, consumption, growth, and liquidity.

Interest-Rate Targets

The specific interest rates that central banks aim for in their monetary policy operations to influence economic conditions.

Money-Supply Targets

Economic policy goals that aim to control the amount of money available in the economy to ensure stability or encourage growth.

Q9: When a parent uses the equity method

Q10: Where may a non-controlling interest be presented

Q14: Webb Co. acquired 100% of Rand Inc.

Q16: Patti Company owns 80% of the common

Q42: These questions are based on the following

Q44: Johnson, Inc. owns control over Kaspar, Inc.

Q57: Cleary, Wasser, and Nolan formed a partnership

Q72: Which statement is true regarding a foreign

Q80: Alpha, Inc., a U.S. company, had a

Q86: Gentry Inc. acquired 100% of Gaspard Farms